People keep talking about how crazy the market is, up more than 25% this year. It's a big year to be sure. But on the the other hand, even though the market has been decent in recent years, it hasn't been particularly bubblicious.

To put the 25% return into context, I think it's a good idea to look at it over 2 years or 3 years. Since the end of 2017, for example, the market has return an annualized 8.4%/year. Pretty good to be sure. Since the end of 2016, its up around 12%/year. Going back five years, it's up 8.8%/year (these figures exclude dividends).

Not bad at all, but not bubble-like either. If you were going to train an AI machine to look for bubbles, you would look at valuations (interest rate adjusted), sentiment etc. But one of the biggest factors that I would include would be historical returns over various time frames; strong performance reinforces the positive loop of increasing positive sentiment -> higher prices -> better-looking historical returns -> increasing optimism and 'proof' (both statistical and social) of the greatness of stocks etc.

The 10-year return is 10.9%/year, but that's off a depressed level due to the great recession. Over 20 years, the market has gone up only 4%/year.

Here is a table of the S&P 500 index change over various time periods.

S&P 500 Annualized Returns Through November 2019 (excl. dvd)

1-year return: 25.30%

2-year return: 8.39%

3-year return: 11.95%

4-year return: 11.34%

5-year return: 8.81%

10-year return: 10.91%

20-year return: 3.87%

30-year return: 7.55%

50-year return: 7.31%

S&P 500 Annualized Returns Through December 1999 (excl dvd)

1-year return: 19.53%

2-year return: 23.05%

3-year return: 25.64%

4-year return: 24.28%

5-year return: 26.18%

10-year return: 15.31%

20-year return: 13.95%

30-year return: 9.67%

50-year return: 9.36%

This is pretty insane. The annualized return over 5 years to December 1999 was 26%! And we are sort of freaking out that the market is up over 25% year-to-date in a single year, and not even double digits annualized over 2 years.

So anyway, that's why it doesn't really feel like a bubble. People aren't quitting their jobs (to trade stocks), buying new cars (with their capital gains), bigger houses and things like that we saw back in 2000. Most people I talk to still tend to hate stocks, the financial crisis still fresh in their minds.

Iger Book

I just finished the Iger book, and it was also a pretty great read. Iger seems like a genuinely nice guy. CEO's tend to have an image of not being nice guys, so it's great to see someone like him make it to the top. It's possible to be decent, honest and honorable and still do well.

Buffett did mention DIS as one of the well-managed companies (along with GE at one point); his relationship with DIS goes back to when DIS bought Capital Cities during the Eisner years (and Iger was working for Thomas Murphy / Dan Burke). And I think it goes even further back than that, actually.

It's fascinating to read about the events that we've been reading about in the newspapers from the people that were involved. This one involves Buffett / Murphy / Burke, Steve Jobs, George Lucas, Pixar and a lot of what is going on in media today. This connects (unintended) to the Malone interview below.

Anyway, this book is a quick read so go get it. By the way, I have not subscribed to Disney+ yet as I am big into Netflix and there is just so much stuff there that I can barely scratch the surface of what I want to watch (by the time I cancelled the DVD part of my Netflix subscription, I had more than 400 DVD's in the queue). My favorite things are the European cop dramas (French, Belgian, German, Norwegian etc.), the Indian and Japanese shows, and of course many U.S.-based shows too. I just watched The Irishman which is really good (creepy is the special effects to make these close-to-80 year olds look middle-aged), but at the same time I also thought, gee, do we really need another wise-guy movie?

OTT Tangent

People keep talking about the competition in direct-to-consumer streaming and how increasing competition will hurt Netflix etc. This is probably true to some extent; when Netflix was the only game in town, that's one thing, but with many participants jumping in, that's another story altogether.

On the other hand, when you think about it, this is not really an either-or world. People aren't going to sit there and debate whether to switch from Netflix to Disney+ or Apple. Netflix charges $14/month or some such thing, and Disney+ is even cheaper.

A lot of people are still paying $100/month or more for the conventional video package ( I dropped that a couple of years ago mostly because I don't watch most of the channels (ESPN, for example), but what bothered me even more was that they were charging me $14/month for each cable box in the house, which seemed ridiculous to me. Those things can't cost more than $100 (look at Roku at $20; and if it actually does cost more than $100, it's for functionality that I don't need), and they are charging $14/month forever; this makes absolutely no sense.

If you cut the chord, you have $100/month in video budget you can allocate (you still need to pay for the internet), so you can have Netflix, Hulu, Disney+, HBO and a few other things and still be under $100...

Malone Interview

There are a few annual events that are really exciting to me. Of course the Berkshire annual meeting (I just watch the video later), annual report, JPM annual report etc.

And another one of those is the CNBC John Malone interview by David Faber. Faber is one of the few people (of the reporters/anchors), if not the only one, who seems to understand the market and business.

Anyway, I jotted down some notes while watching the recent interview (done during the Liberty Media investor day). This is not everything, though, but a large part of it. He also talked about regulation, GOOG etc, for example, so go check out the video.

Here are Malone's thoughts on various topics:

Who is best positioned in streaming right now?

Malone answered by rephrasing the question to, "Who will be around in five years?"

Disney and Netflix.

DIS

Disney has great content, a great global brand, but doesn't have a large direct relationship with customers so must piggy back on those who do, like Verizon.

NFLX

Netflix, so far in the lead, good base / revenue stream.

AAPL

Apple may surprise. Slim content, but has great distribution in their direct customer relationships. They offer free for one year to buyers of AAPL products etc...

AAPL has optionality; see how it goes and decide how much they want to spend (how much they can afford).

HBO, AMZN

HBO is a decent service, but doesn't have the revenue stream to match Netflix.

AMZN has a totally different monetization strategy so... not primary biz.

Content is for marketing. AMZN may evolve to become a bundler of others' content

Tech companies want to be the platform, get info on customers, be gateway,

let others waste money on content.

DIS will be successful.

Direct relationship w/ customer in scale with growth and pricing power is a powerful business model.

DIS knows they need direct consumer relationship.

HBO Max: HBO content budget was $2bn/year.

If you want HBO, you already have it, so not much gain in new customers in the U.S.? Malone doesn't see the growth. Maybe even attrition.

HBO budget is not enough to protect for the long term. Takes years to develop content internationally. Don't own rights to intl distribution. Problem seeing scale at HBO to get to top of direct consumer biz. HBO is the same as it's been for 25 years. If you want it, you already have it so where is the growth?HBO may capture wholesale spread (as big bundle moves to direct).

ATT will face challenges. Historically has been the biggest dog in every fight, but not now, and not in this space (streaming media). About scale and globality. Need global scale, or won't get enough scale to compete in this space. This will be the challenge for ATT, HBO. FANG companies are all global. If you're only in the U.S., how do you compete?

Sports is glue that keeps big bundle together... will eventually blow up. Not sure when... big bundle still overpriced due to sports content...

Content Cost

At some point, hail Mary passes for some will prove to not be working so content cost will moderate. Some will fail (and stop spending) etc...

NFLX will have to moderate spend at some point. Bundling of these services will happen too. Distributors may bundle too, if it reduces churn etc... will evolve like traditional cable. Comcast offers Netflix etc.

Cord cutting will level off. Erosion won't stop completely, though...

Cutting video increases margins at cable companies as margins for broadband is higher. Happening naturally.

Satellite will end up serving people with no other options, rural etc.

Linear TV will lose subscribers, ads, but as you get direct relationships, value of ads go up as you know more about customers. Ad rev potential goes up; more focused ads etc. Have to fight decline in reach due to decline of big bundle. Provide content direct through app and sell content to others etc. Random access via app; if you subscribe to Discovery Channel, you get stuff through app too (not everything).

Cable industry changed when congress changed retransmission constraints; Margins started to go down. Content providers were able to extract more and more...

Will be profitable for people with unique situations, consistent, stable demand, pricing power, level of uniqueness... those businesses ultimately gets regulated.

Discovery

Discovery owns content globally, generating free cash, need to migrate to direct to consumer.

Malone bought more stock this week (November 2019). Discovery will solve issues. Stock is dramatically undervalued. Malone bought $75 mn worth of stock. Growing, generating free cash. Market cap to levered free cash flow, cheapest on screen... They own all their content, generates tons of cash, investment grade b/s, they are growing while others are shrinking (5.5x cash flow). Cheap for good company...

Malone paid $28.03/share.

CBS/VIA

They have no global presence. Lot of content is bought. CBS is totally dependent on sports rights so not sure about long-term profitability. Not sure if CBS has enough power to carry all the channels.

VIA underinvested for many years, bought back stock at high prices, tactical mistake.

How important is MTV, Nickleodean to distributors? Question sustainability of model, and also they are U.S. only.

Yes, stock is historically cheap, but... licensing out content to others. Ice cube melts faster when you don't put content on your own channel.

CBS/VIA needs to get global for long term sustainability. Find niche, glue to make customers sticky. Something unique.

Lions Gate

Sold LionsGate; didn't see them execute strategy of using library/content to drive Starrs. They focused too much on selling content instead of driving their own distribution.

Need global scale, or niche in small area that big guys don't care about to survive.

Wired and Wireless Together

Liberty Global followed strategy based on belief that combination of wired and wireless would lead to synergies. Turned out to be true. Belgium, Holland (combined with Vodaphone). Once they built scale, they were able to acquire. Synergies were real and very substantial.

In U.S, for Charter, same idea. Keep growing until they understand the economics of a combination. At the moment, not far along enough on that path. Once scale is achieved, think about building own network. Hybrid tranmission over time. Could be joint ventures, mergers etc.

Malone interested in Altice, but Patrick wants control etc...

Uber

Not an expert, but doesn't understand Uber, how is scale going to make it profitable? Like selling hot dogs at a loss and making it up in volume. Can't see how scale changes economics. Can't understand why Dara took job.

Politics

Worries about attack on success and wealth in this country.

Worries about where country is going.

If Warren wins, wealth destruction will exceed wealth transfer. Has places in Ireland, Canada, Bahamas etc... (that he can escape to), but Malone rather stay here, be optimistic about balance.

Malone is Libertarian, would vote for Bloomberg.

Trump has right strategy, but not the right guy; he doesn't build a team. A lot of people that worked for him trying to take him down now.

Pages

▼

Saturday, November 30, 2019

Thursday, November 14, 2019

What It Takes, Dimon, Twitter etc.

Recently, I've gotten some emails asking about the blogger email updates. I googled around (again) recently for a solution and couldn't find one, and also looked at some mass email services and they aren't free over a certain number of subscribers.

So, as has been suggested here by some over the years, I just set up a Twitter account to announce when I have a new post.

My handle is: @brklninvestor

I know many of you are not on Twitter, so I will figure out an email solution too, eventually.

Dimon on 60 Minutes

Jamie Dimon was on 60 Minutes this past Sunday. He is still one of my favorite CEOs and is great to watch. I thought his response to the question about running for president was pretty funny; "I thought about thinking about it..." That reminds me of one of my favorite Dr. Who lines (from the Eleventh Doctor, Matt Smith), "Am I thinking what I think I'm thinking?"

Anyway, in this environment, there is no way people like Dimon or Bloomberg would gain any traction in the Democratic party. I think either of them would make great presidents, but it just won't happen. No chance at all, unfortunately.

When Lesley Stahl mentioned the bailout of the banks during the crisis, Dimon should have pointed out that it wasn't really a bailout; all the money was paid back with interest (at least the major banks paid it all back). Schwarzman in the book below talks about how he cautioned Paulson about this; to try to avoid the use of the term bailout as it could become a problem if that word stuck. To this day, I still talk to people who think that the banks were "bailed out". They think that the government just gave the banks free money with no strings attached. They are often surprised to hear that the money has been paid back in full, with interest.

Having said that, the definition of "bailout" seems to be to offer financial assistance to an entity on the brink of collapse, so maybe TARP was a bailout. But still...

When asked about CEO pay, Dimon said, "what do you mean?", or something like that. It was clear he was trying to just avoid the question. To say he has nothing to do with his own compensation, while it may be technically true, wasn't really convincing to people who wouldn't understand. He could have just agreed that CEO pay is too high in this country, and that it should be dealt with at the tax level but probably shouldn't be resolved legislatively or whatever. No need to dodge the question. There is nothing wrong with saying that high income people should pay more in taxes (at higher rates), and that some of the crazy loopholes that reduce tax rates for the rich should be closed etc. He is not running for public office, so he is not taking any risk in saying stuff like that.

But anyway, it was nice to see him on 60 Minutes. Although I am progressive on many issues, I find the current anti-corporation sentiment to be unfortunate. Companies can only change their image by their actions. More and more companies are acting like they are the solution rather than the problem, which is good.

Markets

The markets are kind of crazy. I don't mean this rally, necessarily. A lot of this rally is just recovery from last year's drop and valuations are still in a zone of reasonableness, so I am not at all alarmed by it or worried about it.

I mean the way the markets react to every Trump tweet, or nowadays, Elizabeth Warren ideas. I like Elizabeth Warren a lot, actually, even though she seems to hate Dimon and everything Wall Street.

Whenever the markets tank when Warren's poll figures go up, just remember what happened on election day in 2016; the markets freaked out and tanked when it realized Trump is going to be our next president. But before the next morning, the market took off and hasn't looked back.

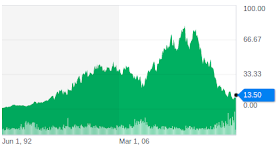

Remember what happened to health care stocks in 1992 (Hillary-care), and 2009 (Obama-care). When widely publicized problems hit the market, it is very hard to predict what will happen. Howard Marks would call reacting to these headlines first-level thinking.

First of all, we don't know if Warren is going to be nominated. Even if she is, we don't know if she will beat Trump. Even if she wins, we don't know how much of her plan can be executed successfully (will she run to the center for the general elections? Will she take a more prudent, realistic course of action once in the White House? I'm not saying her ideas are bad or impractical, but she can calibrate her goals according to the reality she confronts once she's there).

There are so many levels of "unknowns" that it makes no sense, really, to try to discount these things so far ahead.

Anyway, if any of these things move the markets too far in any direction, it's probably a great time to take advantage of it and go the other way.

Growth vs. Value

I hear and read about this all the time, and I totally get it and agree. I am a believer in mean-reversion. On the other hand, there are secular realities hidden in these figures too. For example, Bed, Bath and Beyond (BBBY) is one of my favorite stores and was one of my favorites in terms of management. I followed them closely for years, and eagerly looked forward to their annual reports. But it was always a pretty expensive stock. When it finally started getting cheap, it seemed to have lost it's way.

Maybe I am putting in the bottom in this stock, but these days, it's hard to figure out what this company is trying to be. Not too long ago, you would walk into a BBBY and then, suddenly, in the middle of the store, there would be like a miniature supermarket, with potato chips, cereal and whatnot. I was like, what?

It's like the newspaper business. As Buffett says, if you wouldn't start the business from scratch today, then it's probably not a good business. And if it's not a good business, you probably don't want to own the stock.

Again, I loved BBBY for many years (and it's just luck that it hasn't been a part of my portfolio), but it's hard to think of a reason for it to exist. A lot of what they sell is exactly the sort of thing Amazon is very good at selling, and for lower prices. Stores like Target are also selling similar things for competitive prices, so I guess it's a similar story where Target/Walmart/CostCo and others (Amazon) are killing the category killers; same as CD stores, book stores, toy stores etc.

This is not to say necessarily that we should go long AMZN and short BBBY, JCP and other retailers (well, that's been a great trade for a long time!). It's more of a question about how much of this growth versus value is the usual cyclical thing that will eventually mean-revert, and how much of it is secular destruction of multiple industries (I don't think most retailers will recover).

WeWork/Softbank

This is a fascinating story. I really admire the vision and conviction of Masayoshi Son. He is fun to watch and follow, and I have always wondered when and if I should buy Softbank stock. There were many reasons to buy it, especially the usual discount to the sum-of-the-parts valuation and things like that.

But one thing that has always bothered me was his almost reckless aggressiveness. I guess that's a good thing for someone in that area, but it was always a little too scary for me. I remember watching him in an interview, laughing at the fact that the price of Softbank stock went down 99% (or whatever percentage it was). I don't want the steward of my capital laughing about something like that. It is definitely not funny to me.

Also, the sheer size of some of these investments makes it highly unlikely that they can achieve high rates of return over time. Yes, Alibaba was a huge home run. So was Yahoo Japan and some others. But what were their capitalizations when the investments were made? I don't think they were valued at $40-50 billion. How much money were they losing? Probably not billions. Things are truly insane these days.

Thankfully, that unicorn bubble, at least, seems to have popped for the moment.

Great Book

And by the way, the original intent of this post was about a book. I just finished Schwarzman's book, What it Takes: Lessons in the Pursuit of Excellence and thought it was great. This is not a book you want to be reading in the company of your progressive friends (most of my friends and neighbors are progressive; many are even democratic socialists). Even some conservatives roll their eyes at a guy who throws himself expensive birthday parties and puts his name on library buildings. But I don't care about that. Not everyone has to be like Buffett or Munger.

But what I can say is that after all these years on and following Wall Street, I've mostly heard good things about Blackstone. When they IPO'ed, I followed closely and it was clear that they are a really well-run shop. At the time, Fortress Investment Group was the other private equity firm to go public before Blackstone, and I was really not all that impressed after following them for a while. Their performance was not great, hedge fund was not doing well etc. But Blackstone was at a totally different level.

Whether its their conference calls, presentations, it was all done very, very well.

The only reason I never bought the stock was that, like others, I was worried about the huge increase in AUM at all of these alternative asset managers. How are they going to maintain the high rates of return with ever-increasing AUM and ever-increasing competition, not to mention the corresponding ever-increasing prices? Schwarzman, in the book, makes the case that size has become an advantage for them; they get first call (or are the only call), often because they are the only ones that could close a deal of certain sizes.

I had the chance to grab some shares at under $4.00 during the crisis, but then there were many other things that were cheap too... But still, knowing what a solid shop it was, I shoulda grabbed some shares then. I guess one rule should be that any time a well-run company is trading for the price of an option, one should buy at least some shares!

Special Situations Trade

By the way, I should also mention that these private equity firms are in the process of converting from partnerships to corporations; this expands the range of potential buyers (institutions that wouldn't or can't own partnerships), which would serve to increase liquidity and most likely valuations of these companies.

I know many of us berk-heads think private equity is nothing but leveraging and cost-cutting, but I still think these guys have a high quality shop.

Persistence

One thing that surprised me was how hard it was for Schwarzman / Peterson when they first started up, sending hundreds of letters to investors with no response, visiting potential investors and getting rejected for months on end. This reminded me of what Barbara Corcoran said in an interview once. The interviewer asked her what the difference between a good broker and a bad broker was, and she said the great brokers know how to take 'no'. If they can't close a deal, they move on to the next one and keep going. The bad ones aren't good at taking 'no', and it wears them down; they get discouraged and it impacts them too much to keep going.

I'm sure we've all seen examples of this. A friend once told me a relative wrote a novel, sent it to a publisher and it got rejected and they gave up writing and blames the over-commercialized, corporate-controlled, dumbed-down American culture for their failure as a novelist (and the friend agreed with that). I was a little shocked. So you write one novel, send it to one publisher, it gets rejected and it's all over? Well, I don't know anything about writing novels and have no idea how that world works, so I didn't say anything.

But I was thinking back to the many famous novelists who kept getting rejected from publisher after publisher, writing story after story before getting published. I think Haruki Murakami got published on his first try, but those are probably rare cases.

Going back to Schwarzman, even with his credibility / reputation (and Peterson by his side), they struggled to get Blackstone off the ground. You can imagine how much work it's going to take to get anything done without that sort of advantage.

Having said all that, it is an autobiography so we hear everything from his side. I'm sure there are people with tales out there somewhere he doesn't want told (and this goes for someone like Buffett too!).

But, it's still a good read.

So, as has been suggested here by some over the years, I just set up a Twitter account to announce when I have a new post.

My handle is: @brklninvestor

I know many of you are not on Twitter, so I will figure out an email solution too, eventually.

Dimon on 60 Minutes

Jamie Dimon was on 60 Minutes this past Sunday. He is still one of my favorite CEOs and is great to watch. I thought his response to the question about running for president was pretty funny; "I thought about thinking about it..." That reminds me of one of my favorite Dr. Who lines (from the Eleventh Doctor, Matt Smith), "Am I thinking what I think I'm thinking?"

Anyway, in this environment, there is no way people like Dimon or Bloomberg would gain any traction in the Democratic party. I think either of them would make great presidents, but it just won't happen. No chance at all, unfortunately.

When Lesley Stahl mentioned the bailout of the banks during the crisis, Dimon should have pointed out that it wasn't really a bailout; all the money was paid back with interest (at least the major banks paid it all back). Schwarzman in the book below talks about how he cautioned Paulson about this; to try to avoid the use of the term bailout as it could become a problem if that word stuck. To this day, I still talk to people who think that the banks were "bailed out". They think that the government just gave the banks free money with no strings attached. They are often surprised to hear that the money has been paid back in full, with interest.

Having said that, the definition of "bailout" seems to be to offer financial assistance to an entity on the brink of collapse, so maybe TARP was a bailout. But still...

When asked about CEO pay, Dimon said, "what do you mean?", or something like that. It was clear he was trying to just avoid the question. To say he has nothing to do with his own compensation, while it may be technically true, wasn't really convincing to people who wouldn't understand. He could have just agreed that CEO pay is too high in this country, and that it should be dealt with at the tax level but probably shouldn't be resolved legislatively or whatever. No need to dodge the question. There is nothing wrong with saying that high income people should pay more in taxes (at higher rates), and that some of the crazy loopholes that reduce tax rates for the rich should be closed etc. He is not running for public office, so he is not taking any risk in saying stuff like that.

But anyway, it was nice to see him on 60 Minutes. Although I am progressive on many issues, I find the current anti-corporation sentiment to be unfortunate. Companies can only change their image by their actions. More and more companies are acting like they are the solution rather than the problem, which is good.

Markets

The markets are kind of crazy. I don't mean this rally, necessarily. A lot of this rally is just recovery from last year's drop and valuations are still in a zone of reasonableness, so I am not at all alarmed by it or worried about it.

I mean the way the markets react to every Trump tweet, or nowadays, Elizabeth Warren ideas. I like Elizabeth Warren a lot, actually, even though she seems to hate Dimon and everything Wall Street.

Whenever the markets tank when Warren's poll figures go up, just remember what happened on election day in 2016; the markets freaked out and tanked when it realized Trump is going to be our next president. But before the next morning, the market took off and hasn't looked back.

Remember what happened to health care stocks in 1992 (Hillary-care), and 2009 (Obama-care). When widely publicized problems hit the market, it is very hard to predict what will happen. Howard Marks would call reacting to these headlines first-level thinking.

First of all, we don't know if Warren is going to be nominated. Even if she is, we don't know if she will beat Trump. Even if she wins, we don't know how much of her plan can be executed successfully (will she run to the center for the general elections? Will she take a more prudent, realistic course of action once in the White House? I'm not saying her ideas are bad or impractical, but she can calibrate her goals according to the reality she confronts once she's there).

There are so many levels of "unknowns" that it makes no sense, really, to try to discount these things so far ahead.

Anyway, if any of these things move the markets too far in any direction, it's probably a great time to take advantage of it and go the other way.

Growth vs. Value

I hear and read about this all the time, and I totally get it and agree. I am a believer in mean-reversion. On the other hand, there are secular realities hidden in these figures too. For example, Bed, Bath and Beyond (BBBY) is one of my favorite stores and was one of my favorites in terms of management. I followed them closely for years, and eagerly looked forward to their annual reports. But it was always a pretty expensive stock. When it finally started getting cheap, it seemed to have lost it's way.

BBBY

Maybe I am putting in the bottom in this stock, but these days, it's hard to figure out what this company is trying to be. Not too long ago, you would walk into a BBBY and then, suddenly, in the middle of the store, there would be like a miniature supermarket, with potato chips, cereal and whatnot. I was like, what?

It's like the newspaper business. As Buffett says, if you wouldn't start the business from scratch today, then it's probably not a good business. And if it's not a good business, you probably don't want to own the stock.

Again, I loved BBBY for many years (and it's just luck that it hasn't been a part of my portfolio), but it's hard to think of a reason for it to exist. A lot of what they sell is exactly the sort of thing Amazon is very good at selling, and for lower prices. Stores like Target are also selling similar things for competitive prices, so I guess it's a similar story where Target/Walmart/CostCo and others (Amazon) are killing the category killers; same as CD stores, book stores, toy stores etc.

This is not to say necessarily that we should go long AMZN and short BBBY, JCP and other retailers (well, that's been a great trade for a long time!). It's more of a question about how much of this growth versus value is the usual cyclical thing that will eventually mean-revert, and how much of it is secular destruction of multiple industries (I don't think most retailers will recover).

WeWork/Softbank

This is a fascinating story. I really admire the vision and conviction of Masayoshi Son. He is fun to watch and follow, and I have always wondered when and if I should buy Softbank stock. There were many reasons to buy it, especially the usual discount to the sum-of-the-parts valuation and things like that.

But one thing that has always bothered me was his almost reckless aggressiveness. I guess that's a good thing for someone in that area, but it was always a little too scary for me. I remember watching him in an interview, laughing at the fact that the price of Softbank stock went down 99% (or whatever percentage it was). I don't want the steward of my capital laughing about something like that. It is definitely not funny to me.

Also, the sheer size of some of these investments makes it highly unlikely that they can achieve high rates of return over time. Yes, Alibaba was a huge home run. So was Yahoo Japan and some others. But what were their capitalizations when the investments were made? I don't think they were valued at $40-50 billion. How much money were they losing? Probably not billions. Things are truly insane these days.

Thankfully, that unicorn bubble, at least, seems to have popped for the moment.

Great Book

And by the way, the original intent of this post was about a book. I just finished Schwarzman's book, What it Takes: Lessons in the Pursuit of Excellence and thought it was great. This is not a book you want to be reading in the company of your progressive friends (most of my friends and neighbors are progressive; many are even democratic socialists). Even some conservatives roll their eyes at a guy who throws himself expensive birthday parties and puts his name on library buildings. But I don't care about that. Not everyone has to be like Buffett or Munger.

But what I can say is that after all these years on and following Wall Street, I've mostly heard good things about Blackstone. When they IPO'ed, I followed closely and it was clear that they are a really well-run shop. At the time, Fortress Investment Group was the other private equity firm to go public before Blackstone, and I was really not all that impressed after following them for a while. Their performance was not great, hedge fund was not doing well etc. But Blackstone was at a totally different level.

Whether its their conference calls, presentations, it was all done very, very well.

The only reason I never bought the stock was that, like others, I was worried about the huge increase in AUM at all of these alternative asset managers. How are they going to maintain the high rates of return with ever-increasing AUM and ever-increasing competition, not to mention the corresponding ever-increasing prices? Schwarzman, in the book, makes the case that size has become an advantage for them; they get first call (or are the only call), often because they are the only ones that could close a deal of certain sizes.

I had the chance to grab some shares at under $4.00 during the crisis, but then there were many other things that were cheap too... But still, knowing what a solid shop it was, I shoulda grabbed some shares then. I guess one rule should be that any time a well-run company is trading for the price of an option, one should buy at least some shares!

Special Situations Trade

By the way, I should also mention that these private equity firms are in the process of converting from partnerships to corporations; this expands the range of potential buyers (institutions that wouldn't or can't own partnerships), which would serve to increase liquidity and most likely valuations of these companies.

I know many of us berk-heads think private equity is nothing but leveraging and cost-cutting, but I still think these guys have a high quality shop.

Persistence

One thing that surprised me was how hard it was for Schwarzman / Peterson when they first started up, sending hundreds of letters to investors with no response, visiting potential investors and getting rejected for months on end. This reminded me of what Barbara Corcoran said in an interview once. The interviewer asked her what the difference between a good broker and a bad broker was, and she said the great brokers know how to take 'no'. If they can't close a deal, they move on to the next one and keep going. The bad ones aren't good at taking 'no', and it wears them down; they get discouraged and it impacts them too much to keep going.

I'm sure we've all seen examples of this. A friend once told me a relative wrote a novel, sent it to a publisher and it got rejected and they gave up writing and blames the over-commercialized, corporate-controlled, dumbed-down American culture for their failure as a novelist (and the friend agreed with that). I was a little shocked. So you write one novel, send it to one publisher, it gets rejected and it's all over? Well, I don't know anything about writing novels and have no idea how that world works, so I didn't say anything.

But I was thinking back to the many famous novelists who kept getting rejected from publisher after publisher, writing story after story before getting published. I think Haruki Murakami got published on his first try, but those are probably rare cases.

Going back to Schwarzman, even with his credibility / reputation (and Peterson by his side), they struggled to get Blackstone off the ground. You can imagine how much work it's going to take to get anything done without that sort of advantage.

Having said all that, it is an autobiography so we hear everything from his side. I'm sure there are people with tales out there somewhere he doesn't want told (and this goes for someone like Buffett too!).

But, it's still a good read.