There was some fun stuff in the beginning (with a disturbing slide of Greg Maffei doing some sort of dance) and then Maffei (LMCA), Meyer (Sirius XM), Rutledge (Charter) and Rapino (Live Nation) did presentations on their businesses.

Anyway, I will cut and paste a whole bunch of stuff from the presentation as it's easier to do that than to type stuff up myself.

This will be sort of a summary, but not a complete summary. This is sort of a note to myself so I will add thoughts along the way. Maybe it will be helpful for people who don't want to sit down for two hours to listen to the webcast.

Those interested in LMCA should at least go look at the slides (much of them are here, but many more in the original presentation) and if you have time, listen to the presentations. They are really well done, and the Q&A afterwards is very interesting.

John Malone is one of the legendary people in business and he is always worth listening to. You can learn a lot about many things by listening to him. Just like you learn a lot about banking by listening to Jamie Dimon and learn a lot about everything from listening to Buffett, you learn a lot about cable, media / entertainment from listening to Malone.

Anyway, here is one of the 'fun' section slides from the presentation:

Non-New Yorkers might not recognize the buildings in this photo, but that's the Time Warner Center in New York City. Maffei was talking about a fictional radio station on Sirius XM (called Malone's Melodies). The tune playing is "Time Is On My Side", so you know they really want to do this deal.

News

LMCA did a series of deals to raise some cash (that was used to pay down margin debt). LMCA continues to repurchase shares. As we'll see later, they have already bought back more than half the shares in the recent past. The repurchase of 5.2% of LMCA from Comcast in a tax-free exchange was priced at $132/share. LMCA still has $327 million in repurchase authorization after this deal (details of this deal are in the presentation slides).

The sale of SIRI shares back to SIRI also comes tax efficiently as this was some of the high basis stock that LMCA owns and effectively gets dividend treatment for tax purposes.

The convertible bond deal is a tax efficient way to lock in some low funding rates for the long term (10 years).

As a result, LMCA has been able to pay down much of the margin debt they took on when they bought Charter. Maffei used the term "reload the gun" to describe what these transactions did. Those words should excite people who are looking for LMCA to do more deals. Well, maybe they are getting ready for Time Warner Cable.

LMCA is very shareholder friendly (we already knew that), but this chart is incredible. They've bought back more than half of their shares since 2008, and they still have plenty of liquidity (borrowing capacity, high basis SIRI shares etc...).

Stock Price Performance

LMCA share price performance has been amazing too, and recent performance is not just a recovery from the crisis lows. The CAGR is +36%/year since 2006, so that includes the crisis.

Sirius XM (SIRI)

Jim Meyer made a presentation about SIRI which I thought was very interesting. He addresses some of the questions that critics raise.

Of course, LMCA bought SIRI as a distressed situation and did very well with it, but Malone sees a lot more growth ahead for SIRI.

One of the issues is competition from internet radio, like Pandora and music services like Spotify. Meyer points out that SIRI is not a music company. SIRI does music, talk and sports:

Also, with respect to competition from internet streaming services, Meyer points out that the big competitor out there is still terrestrial radio:

The following charts show the superior earnings model versus the competition:

Growth

The following charts show subscriber, revenue and EBITDA growth:

Increasing Margins

Meyer said that SIRI can safely get to 40%+ EBITDA margins at maturity. He said this is doable due to the scalability of the business.

But at the end of the day, what's really important is free cash:

and free cash per share:

He said he is asked what he values more; subscriber growth, revenue or EBITDA? He said "yes" to all but free cash flow per share growth is most important.

Growth is linked to new auto sales, obviously, and here's the trend and forecast (auto industry forecast). SIRI has been increasing share in new auto sales.

What's interesting is that even if new auto sales flatten out, SIRI can still grow subscribers because every new auto sale is a potential new subscriber (assuming the new car buyer didn't have it before; otherwise I suppose a driver just replaces a car so subscriber count won't change).

Anyway, SIRI did some work on this and shows the growth potential based on projected new car sales:

Meyer said that they are very comfortable that they will reach more than 100 million enabled vehicles by 2018 (enabled vehicles is not the same as number of subscribers, but shows the potential).

Their balance sheet looks much better now than before at 2.7x leverage (versus 3.5x target):

The other big growth area is used cars. The used car market is 3x larger than the new car market and this area has a lot of potential. Also, connected vehicle services (telematics) is another area of growth potential that Meyer talked about.

As Malone mentioned in the Q&A later, he sees a lot more growth to come at SIRI.

Charter Communications (CHTR)

Tom Rutledge did a presentation on CHTR. This is actually a pretty exciting situation, I think. There is a lot more on the topic in the Q&A where Malone talks a lot about the history of cable and what he sees happening there going forward.

One of the reasons why I got interested in CHTR and LMCA (I have owned LMCA and DISCA in the past but haven't followed them too much recently until early this year) again is because I thought that the industry was coming to some big inflection point. For many years, cable companies just kept growing by adding subscribers. They were making so much money and growing so much that they didn't really care what they paid for content as the subscribers paid for them. That's why I was always a fan of content; I've owned Disney and CBS in the past for that reason. I figured content providers will always get paid regardless of what happens in the distribution world. For all I care, the phone, cable and satellite companies can fight it out and destroy each other, but they will all still have to pay high fees to ESPN. So as a Disney shareholder, I was indifferent to what happened in the pipe wars. Who cares who won. They will all just have to pay more to get more content to compete even more.

Then cable got saturated (well, it has been saturated for a while) and stopped growing and then phone companies came in with video offerings, and of course satellite companies continued to take share away from cable. So, all of a sudden, with distributors unable to grow (due to saturation), and prices of content continuing to go up and customer cable bills rising, new alternatives pop up, like Netflix, Hulu, Youtube or whatever else.

Distribution companies start wondering why they are paying so much money to content providers when the same content can sometimes be viewed elsewhere for free.

In any case, I don't really understand the media business that much, but all of this stuff was the impression I was getting. The industry seemed really ripe for a change. Business as usual just wasn't going to work anymore.

And then LMCA takes a big stake in CHTR. So for me, this deal coincided with my feeling that something is happening in the industry, or at least something is about to happen. At first, I wasn't sure how the industry can change. I thought, like everybody else, that cable was under pressure from phone companies and satellite providers, and increasingly from over-the-top TV. I did understand that their ownership of the last mile into people's homes was a big asset but it wasn't really clear to me how the cable companies with their video package (which Malone himself said will be obsolete in five years or less) will compete with the over-the-top guys like Netflix.

Now I think I understand this a lot better what can happen.

Anyway, let's get back to the CHTR presentation where Rutledge explains why CHTR is such a great opportunity.

CHTR History

Rutledge started by explaining the history of CHTR. It was founded by Paul Allen. They assembled a big system by paying very high prices and spent a lot of money creating a state-of-the-art network. Because of the high prices they paid and poor management, they went bankrupt. They then had to cut cost where they shouldn't have leading to poor service etc. As a result of this, CHTR has the lowest product penetration.

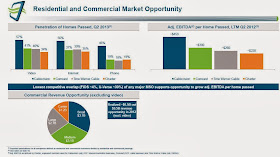

So a lot of the growth story here is just bringing things back up to where they should be in terms of product penetration. Here is a slide that shows the potential for CHTR:

Also, FiOS competes in only 4% of CHTR's markets. As for satellite competition, CHTR's edge is that they have two-way connectivity versus one-way for satellite.

Malone said a while ago in an interview that he thinks CHTR can get competitive high speed internet at a much lower cost than others (fiber optics etc.). Here is a slide that shows how this can happen:

This is the other story for CHTR. By going all digital, they free up a lot of broadband on their cables that will allow them to increase speed / capacity for high speed internet and other things.

Rutledge says that capex is high now due to spending related to going all digital, but once that is done capital intensity of the business should go down. Along with increasing revenues, this should boost EBITDA going forward.

There are a lot more details in the presentation, but the CHTR story is pretty simple; reversing the years of undermanagement to boost revenues, going all digital, decreasing capex needs going forward and operating leverage from that.

Live Nation (LYV)

Frankly, Live Nation has never been on my radar. I always thought of the concert industry has one that makes money from the occasional Rolling Stones fairwell tours, Kiss reunion tours and things like that. I think for many years (not that I follow this stuff) the highest grossing concert tours tended to be these old, boomer-generation rock bands. So Michael Rapino's presentation was an eye-opener for me.

Growth

First of all, I was wrong about the concert industry. Who knew it was a growth business? I don't go to concerts anymore, so I guess there would have been no way for me to know anyway. But here it is:

And look at 2013 growth by region:

...and for ignorant people like me who think only U2 or the Stones can sell tickets, check this out:

I don't know if I should be proud or embarrassed to say that I have no idea who these people are. OK, I know Fleetwood Mac, Depeche Mode, Kid Rock and Beyonce. Not bad, I guess...

So why is it growing so much? What's different now than before? This is an interesting thing that Rapino said. He explained that concerts these days are driven by fan demand. In the past, concerts have been driven largely by record labels. It was the record distribution model that included concerts as promotional events to sell records.

Now concert demand is driven by fans, and how this is done is very interesting: It is done through social media like Youtube, Facebook etc.

Check out this slide:

So we see that only 17% of the Rihanna concerts take place in the world excluding North America and Western Europe, but 56% of her fans on Facebook and 40% on Youtube are from this area.

If you ever wonder who benefits or makes money from Youtube or Facebook, well, now we can think about LYV.

The live concert business is not a particularly high margin business. So that may be another reason why I wasn't too interested in LYV before, but the LYV business model is actually to use the live concert business to drive the other high margin businesses:

They are also increasing business through mobile (another question people keep asking; how people make money off of mobile), and their secondary ticket sales business looks pretty interesting. There is a bunch of stuff in the presentation that you should look at if you're interested.

But the bottom line is that all of this is leading to some interesting growth:

Anyway, I've never looked at LYV in detail so I don't know where all the above numbers lead in terms of valuation, but there seems to be no doubt that it is growing at a decent rate and there seems to be some more growth opportunities in the future.

So that's it on the business presentations.

And then there was what many may consider the most interesting part of the day.

Q&A Session

Malone and Maffei took questions from investors and there were some interesting discussions on various topics. Anyway, these are from my messy notes so not word-for-word or anything.

Why continue to keep owning SIRI? Why not spin it off?

They like SIRI. LMCA has no big free cash generating assets. SIRI is the only big one. It's ability to generate capital for LMCA to use is interesting.

SIRI is also a work in progress. They feel they can still help SIRI.

Maffei mentioned that historically, LMCA has spun off assets when the value of an asset was not recognized by the market, or when a business has reached an apogee. They think neither is the case at SIRI. The value of SIRI is well recognized inside of LMCA now and there is much more they can do there. There is still "a lot of upside".

Malone says CHTR will require capital (Time Warner?). SIRI will give them the financial flexibility to "chase a few more rabbits".

Malone also said that there are still some synergies in the music business that hasn't been exploited (and LMCA can help SIRI with that).

Is there more tension between programmers and distributors now? Relationship more complex, more aggression than in the past? Is this a reason for consolidating?

Malone said that programmers and distributors have had good relations for years. It was all about who could create economic value. The over-the-top phenomena is creating unusual tension. TV everywhere would create value for everyone. Distributors and content providers still have huge monetization systems to defend. They will eventually realize that. Consolidation will make it easier. Fewer rational players works better than more, but is is not the primary reason to consolidate.

Dilution at CHTR in case of Time Warner deal

LMCA would like to keep interest above 25% for future flexibility. LMCA would purchase more CHTR to keep interest above that level to offset dilution, for governmental reasons. He explained later that the Investment Company Act makes a 25%-owned asset a good asset, and one under 25% a bad asset. I think he meant that under 25%, the ICA would deem it a passive investor interest or an investment security so would make LMCA an investment company, whereas owning more than 25% would make it an operating subsidiary (so wouldn't make LMCA an investment company).

Competition to Cable

Malone feels that the long term competitive position of cable is good. Increasing digitization of video will free up bandwidth,and increase speed and capacity of internet delivery. Cable has a marginal cost advantage (a tremendous advantage) for base network.

He mentioned that DT (Deutsch Telecom) put in a volume cap. DT provided content is not included in the volume cap but non-DT content is. The regulators are currently digesting this so don't know what will happen.

Malone mentioned that eventually terrestrial carriers will have to price traffic based on volume. The current model is unsustainable as revenue and pricing won't reflect capital pressures of the providers.

Over-the-top content can be bundled with broadband and when that starts to happen, cable can clawback share from satellite. Cable market share will grow because of services bundled. (Somewhere he said that cable will get at or equal to fiberoptics in terms of speed).

Intrinsic Value versus Price of the Parts

Someone asked him how he viewed the prices of LMCA holdings versus intrinsic value.

Malone said that he has always been a leveraged free cash flow investor, so he discounts the free cash flow at whatever interest rate they can fund at. If you lengthen the maturity and fund at current levels, he says that the "multiples look low to me".

Importance of Content? Does CHTR need more content? Comcast bought NBC

Malone said that the control of content is an important determinant of market share. He then went on to explain the evolution of the cable business.

Cable in the early days was highly balkanized. There was no ubiquity and they didn't compete with each other. Back then, the opportunity for cooperation, scale and uqiquity was obvious.

TCI did one acquisition a week for ten years.

As an industry, they got together to cooperate. They organized joint ventures. For example, in technology they created the MPEG video compression, coaxial cable architecture etc... In content, they created Discovery, BET, Telemundo etc... The industry created 23 or 24 programming vehicles that the cable industry collectively invested in.

Ted Turner was an entrepreneur that got the support of the industry. TCI was a founding investor in Fox News.

The industry solved the balkanization and scale problem by joint effort. Malone says it can be done again. Hulu can be syndicated, or something created from scratch.

He mentioned Comcast, as big as it is, can't buy national level content. It's not big enough. You have to be pretty big to get content for TV everywhere.

So this cable industry inability to buy or create content has benefitted Netflix. They buy nationally, distribute ubiquitously and their local distribution is incrementally free. This is not a situation that can persist indefinitely.

Cable industry is in the need of organizational development.

HBO transformed the cable industry and "made us all rich". If there is an equivalent to that, of course they would be more enthusiastic in investing in the business. M&A and industry cooperation go hand-in-hand.

(At some point the Microsoft purchase of Comcast shares was mentioned, and Maffei was actually at Microsoft at the time and did the deal; so we know he knows the business)

Investment opportunities? Which Liberty entity is the cheapest?

Malone said international (non-U.S.) is where the opportunity is now. He said don't put all your eggs in the U.S. basket. There are some rabbits outside of the U.S., but obviously he can't say what looks good.

Mobility?

75% of mobility is is wifi (and rising). The implication is that mobile traffic will end up on cable (wifi -> cable connection) and not cellular network.

With over-the-top and TV everywhere why do consumers need aggregation interface and pay economic rent?

Netflix, Hulu and other streaming models offer content without economic rent.

Malone said that the answer to that is that they don't need it.

Why did HBO come into existence? Why didn't Hollywood sell directly to cable operators? They couldn't work together. This created opportunity for HBO to get scale. Once they had scale, they didn't need all the studios so changed pricing power.

Over the top guys will get content through scale; original and unique content. Netflix has enough scale to get exclusion and original content.

Netflix

Netflix started as a library of old content. They built a business on low distribution cost (almost free); heavily subsidized U.S. Postal Service. Netflix migrated to streaming service. They have gained scale and ubiquity of presence. The cable industry has been very slow and that gave a window of opportunity to the over-the-top guys.

With network neutrality (free incremental distribution cost) and scale, they have "quite a good business".

A year ago NFLX was written off by many, but it's good that NFLX survived. If it was bought by someone with deep pockets it would've been more dangerous; someone with infinite capacity to underwrite their strategy of buying exclusive content.

NFLX has scale and uniqueness to do well now (but as he said before, this is not sustainable).

So that's about it.

My Thoughts

I do like LMCA and CHTR; I find them very interesting situations (SIRI and LYV don't look too bad either). As far as valuation is concerned, it seems like most of LMCA value is driven by the large listed holdings. The multiples look high, particularly on the big SIRI position, but the growth rates are pretty high too. If they keep growing subscribers and their margins get up to over 40% (EBITDA margins) as they say, it can be pretty interesting.

On the other hand, for an entity like LMCA at this point in time, I tend to think the bigger question is what LMCA does with the liquidity offered by SIRI over time.

I would tend not to look at it like, "what is SIRI actually worth and how much per LMCA share is that?". My question would be more like, as LMCA liquidates SIRI over time (via SIRI buybacks and maybe other transactions), what do they invest in next?

LMCA is obviously holding SIRI for the cash generation ability so more interesting to me is what they invest in with the cash from SIRI rather than what SIRI is worth.

This is not to say that it doesn't matter what SIRI is worth. Malone said that SIRI gives them the flexibility to "chase a few more rabbits". I'm sort of more interested in the "rabbits" than satellite radio.

Still, it's good to know that Malone thinks there is still a lot of upside there even as they use SIRI as a source of liquidity.

How are any of these cheap?It is difficult for me to see how I would not be over paying.

ReplyDeleteHi,

DeleteThey don't look so cheap in the conventional sense. My comfort level with CHTR comes from the tax asset and the low product penetration (and therefore potential growth in EBITDA/sub). It seems like a mathematical certainty that EBITDA will rise as investment related to going digital tapers off. But the most interesting aspect for me is that this is a vehicle for Malone's value creation. Malone doesn't just buy stuff for the sake of gaining size or power; he creates value. So I wouldn't look at CHTR as a straight comp to other cable companies in that sense. It is a special situation for sure. Whether it works out or not is another question, of course.

SIRI valuation does look very high and that is a big chunk of the value of LMCA. For me the question is how the cash generated from SIRI is invested over time. It's a source of capital for LMCA for value-creating investments. I don't think I would buy SIRI stock. I know this doesn't make sense; why would you buy LMCA if you wouldn't buy SIRI? Again, it's because of where that money goes. The rabbits that Malone talks about is what I'm more interested in. Outright SIRI shareholders would own the satellite radio business and that's it. They may still do well, of course. But in five years I would guess that LMCA will look very, very different.

These entities, kind of like the old Leucadia are tricky; a quick snapshot sum of the parts will give you a good indication of what something is worth at a given moment, but it may not really help you to develop an idea of what it will be worth over the long haul because the portfolio composition changes so often.

So for example, a SIRI shareholder (and LMCA shareholder too) might look at it and try to figure out where it goes over the next five to ten years and then figure out what it might be worth. But I lean more towards thinking of it in terms of LMCA opportunistically and tax efficiently winding down the position; how quickly can they do this and where do they deploy this capital? And in the mean time, can they keep SIRI growing so that hopefully it's value keeps going up while they do this?

I don't know if I am making any sense, but there is a subtle difference in my thinking about it.

In any case, I probably SHOULD have a much more solid feel for what SIRI is worth since it is such a big chunk of LMCA's value.

But then again, we have Malone who is an incredible deal-maker thinking of ways to extract value out of this situation.

(An example might be Leucadia shareholders trying to figure out what Wiltel is worth... they may have liked or not liked LUK because of what they thought of it. It turns out that it was a disaster, but LUK didn't lose money on it and managed to walk away with a huge tax asset)

Anyway, that's the sort of fuzzy way I think about it, and I know it's a little fuzzy, lol... Sorry.

Oops, forgot the most important point about SIRI valuation. People look at EV/EBITDA and see something like 24x or whatever it was. And then look at Cablevision at 8x. Yes, SIRI looks cheap, but according to the slides (I should've pasted that in my original post), Free cash/EBITDA at SIRI is 77% versus 23% at Cablevision. So SIRI generates 3 times more free cash per EBITDA than Cablevision. So if you divide the 24x by 3, you get 8x (sort of a backward way of comparing EV/FCF).

DeleteSo in that sense, SIRI is not actually that expensive at all.

Don't forget, Malone says that he has "always been a leveraged free cash flow investor". And on a free cash flow basis, SIRI doesn't look expensive at all.

Oops, the above should say "Yes, SIRI looks expensive" (at 24x EV/EBITDA), not "Yes, SIRI looks cheap, but..."

DeleteSIRI is at 25 times FCF. Market cap / FCF = 22950 / 915.

DeleteWhat about buying puts on SIRI and long LMCA if the idea is to go long Malone's capital allocation?

ReplyDeleteThat's an interesting thought. But I would be a little careful as these guys are very, very active and very focused on value creation. So unless something was ridiculously priced, it might be better to not buy puts against it. Think about the fact that leverage at SIRI is down from 6.7x to 2.7x and their long term target is 3.5x. This leaves them room to do accretive deals (that may help absorb the tax loss), and even if not, they may borrow to repurchase more shares over time.

DeleteThere are a lot of levers here that they can use to create value all over the place, so I wouldn't really look at SIRI as a static, passive holding that you would want to hedge against. This is all these guys think about, how to create value, how to not pay taxes etc...

But if you really like Malone but really dislike SIRI, then maybe it's a good idea to buy SIRI puts. I just don't see that as a great idea at the moment...

Thanks for reading.

Malone's comments on Netflix were much less negative than you make them out to be. He is certainly talking his own book and trying to get paid twice by having Netflix pay the cable companies for distribution (How much does Google pay for distribution? How much do Discovery or ESPN pay for distribution?), and I don't blame him for that, but he clearly stated that he thinks Netflix will do well going ahead "no matter what".

ReplyDeleteThat's a fair point. He did say that Netflix now has the scale to do well going forward. But he also said that these guys have taken advantage of the no-action of the cable industry, implying that things might change. It doesn't mean that Netflix will disappear or go bust, but the dynamics may certainly change in the future.

DeleteCable companies are trying to get paid for heavy traffic so Google is also in the same situation, especially youtube and other heavy traffic stuff. As for ESPN and Discovery, they are actually PAID by cable companies to carry them so obviously they don't pay for delivery.

Anyway, I didn't mean to suggest that Netflix is going to go bust or anything like that (or that Malone suggested that).

Cable companies are trying to get paid as much as they can, regardless of their costs. Why do phone companies charge $20/month for text messaging, which costs almost nothing to provide? Because they can get away with it. I note that cable companies love to talk about how while the video business is facing cost pressures the high speed data business has wonderfully high margins. Why do consumers buy such high margin data plans? Mostly in order to get services like Netflix. Cable is trying to get earn high margins coming and going. There is no basic economic reason this should be the case, as you point out vis-a-vis cable companies paying in order to distribute most cable channels. Malone's stance is a bit much because he is trying to cloak his self-serving economic argument in language of "fairness".

ReplyDeleteYes, I understand your viewpoint. Malone has been like that since the beginning, and it has usually served his shareholders well. I wish other CEO's would be as good.

DeleteThings have changed a lot over the years and there is a tendency for some parts of the economy to not adapt to it. Banks and bank regulations come to mind. The cable industry is going through this now. The ones that adapt will survive, and may even make out really well.

I tend to think that now is that sort of time in the cable industry and there are opportunities and who better to hitch a ride with than Malone? That's pretty much the story here. And I love how he talks about his stance, "cloaking" his self-serving interest. I'm sure he has plenty of enemies, but he also tends to get people together to do things so they ALL make money. He did it before in the 80s and 90s and he sees an opportunity to do that now.

Who knows if he will be able to get tiered pricing for cable internet access? Even if not, as he said, there are other ideas like bundling internet access plans with video (not traditional cable, but some sort of over-the-top plan) etc...

Either way, it's a very interesting situation.

Like the write up.. You should follow our blog. We try and write up different things in a different style and, like you try and teach those that are less experienced a few things. We wrote up LYV earlier this year.. I don't go to concerns any more either.. But found the company intriguing anyway.. http://investing501.com/2013/05/live-nation-everybody-wants-to-rule-the-world/

ReplyDeleteHi,

DeleteThanks for reading. Your blog looks good. I will read LYV later.

Thanks for this very informative thread. A quick back of the envelop calculation indicates that the per share value of Liberty Media's interest in Sirus, Charter Communication, Live Nation and other AFS securities, minus debt is worth about $127 per share (the calculation is based on the latest 10K, adjusting market caps for Sirus, Charter Communication and Live Nation based on today's prices). Doesn't this make the current LMCA equity valuation of $155 per share quite attractive? Thanks.

ReplyDeleteHi,

DeleteIf you look at the pro forma balance sheet from the October investor day presentation, I think the sum-of-the-parts is worth more like $147 (at October 4 prices). I don't know what you did wrong but don't forget that SIRI is now consolidated so much of the debt on the b/s is for SIRI, not LMCA, so if you deduct all the debt including the SIRI debt, you will be off.

Thanks for reading.

Just a quick question. In calculating this sum-of-the-parts calculation do you include taxes? I mean selling (for exemple SIRI shares) would trigger quite a substantional tax payment.

DeleteGood point. You must be new to John Malone: he does not pay taxes. He will find a way to get out without paying taxes on it, or at the end just spin it off (in which case your tax basis on SIRI would be based on what you paid for LMCA). Malone is all about generating free cash and distributing it to shareholders with minimal tax impact.

DeleteBut yes, usually (like Yahoo/Alibaba), you would need to adjust for tax.

Thanks for reading.

This post was great, and stuck with me for a long time (clearly). Went out and read the outsiders and learned all i could about John Malone. A few weeks later, my only problem is making a decision between liberty and charter. Wondering if you had any insights in deciding on one or the other...Malone's a legend, but Rutledge seems great too. The Tiger Cub made a good case (as did u) for Charter being really cheap and a cash flow machine. I have very little experience in these situations, but realize essentially that both of these are ways to play the value creation of malone or malone/rutledge. Which way would you go?

ReplyDeleteHi,

DeleteI actually own both. If you like CHTR, I would just stick to CHTR. But LMCA is sort of like Malone's flagship investment entity so that's a good one too even though a lot of their market value now is based on SIRI (Barron's had a nice article on why SIRI is cheap).

There are other entities too, like Liberty Interactive and Liberty Global. Liberty Global is very interesting because Malone is doing the same thing with cable in Europe, and cable is just getting started in many places in Europe. Malone has also said that many of the opportunities going forward will be in Europe.

Anyway, good luck!

Thank you.

ReplyDeleteIt seems like a solid move, but any thoughts on Liberty's offer to take over Sirius entirely?

ReplyDeleteHi,

DeleteI haven't looked at it in detail and haven't listened to the conference call yet, but my first impression is that it's a good move. Why not? They get direct access to SIRI's free cash and tax asset (subject to whatever change of control limitations they may be subject to). If they can pull it off by issuing shares and then creating a tracking stock so SIRI shareholders can still be SIRI shareholders, it sounds good to me.

But again, I haven't looked at it yet in detail.

If Liberty already owns 53% of SIRI, why can't it just outvote the minority and takeover SIRI? Is Liberty just being nice or is it legally required to get the approval of a majority of the minority?

ReplyDeleteSIRI is pegged near 3.68 while LMCA keeps dropping. The way their exchange ratio works, the more LMCA drops relative to SIRI, the more LMCA shareholders lose.

Do you think Malone at 72 is still smart enough to navigate this mess or has his brain gotten too old?

The special committee of SIRI's board has to approve before this moves forward. And yes, they do need approval from the majority of the minority, non-Liberty SIRI shareholders.

DeleteI think the exchange ratio is fixed, but it will be renegotiated if there is no premium, of course, so in the end that's true. But pre-merger LMCA and post is so close (SIRI big piece of value) that it won't make that much of a difference, I don't think.

I haven't heard, read or seen anything to indicate that Malone is any less sharp than he has been, and in this day and age, 72 is not all that old. Look at the octagenarians that Ackman is battling at Herbalife; they all look pretty sharp too in their 80s (or close to 80).

So I don't view 72 as old at all, escpecially for these very active types.

LMCA has lost 11% since they announced their share exchange plan. During the same period, SIRI has fallen less than 2%.

DeleteI can't wait to see this end. If people are shorting LMCA and buying SIRI, what are they thinking?

Or could it be that because SIRI is not owned by institutions, it has fallen less in this correction? Maybe institutions are not allowed to buy a $3 stock?

I finally started to look at Charter more seriously. Just seems like it warrants at least an investigation given how many smart people have bought in.

ReplyDeleteTo me the the biggest problem is in video. You mentioned Malone believes that tradition video package will become obsolete in 5 years (seems aggressive). And that's half their business. Cable's competitive strength is in Internet services, but everything else is under assault. You also mentioned cable companies can adapt by bundling over the top content with broadband. I'm just wondering how things shake out once the dust settles. Net positive/neutral/negative? It also looks like Netflix will become that intermediary between content owners and ISPs (heck Netflix is producing quality original content themselves). Then there is the "peering" deal that's recently struck between Comcast and Netflix. Now Netflix actually has to pay for their customers' disproportionate bandwidth consumption. There're just so many moving parts it makes my head spin.

Hi,

DeleteIt's hard to tell how things will work out going forward, but the important thing is that CHTR has the fat cable that goes into the houses/businesses. That's really key. And they say capex should go down eventually freeing up a lot of cash (there was some discussion about that on the recent conference call as it seems like capex will be high this year too; management's answer is that this capex is driven by growth). If you look at Washington Posts cable business, for example, and listen to Don Graham, they have basically given up on the video side of the business, but they make a ton of cash with the fat cable.

So however it works out, CHTR will still have a position. Satellite doesn't have that high speed two-way connection.

Anyway, it will be interesting to see how this unfolds.

I agree that the pipe is the main asset for cable companies. By the way, after reading more about the interconnect deal, I should correct some of what I said. It appears that these sort of deals happen all the time and is probably immaterial revenue/cost wise for either Comcast or Netflix.

DeleteDoes Malone have any ideas other than CHTR? I am a bit nervous about cable. Recently, Google Fiber said it is interested in setting up networks in 34 other cities ( http://online.wsj.com/news/articles/SB10001424052702304275304579393213607379066 ).

ReplyDeleteThey sell 1Gbps for $70 per month - Comcast charges $399/month for 1Gbps.

Google makes its own networking gear too. They can leap-frog the legacy networks that the old cable companies have. I don't think cable will have the same pricing power 5-10 years from now, thanks to Google. The FCC is also thinking of regulations that would encourage fiber networks in municipalities.

Hi,

DeleteYou can look at some other Liberty Media holdings, like Live Nation or Sirius. Also, Malone has said that there is more opportunity in Europe at this point so Liberty Global is worth a look (lot of smart investors there too). And then there is Liberty Interactive which holds a lot of content stuff. Of course, Starz and Discovery Communications are big Malone holdings too; they are content so no worries about the pipe wars (although there are other worries).

As for competition with Google and others, I wonder how much Google is willing to spend. It is very costly to built out the infrastructure. Also, fiber in municipalities is questionable given the financial conditions of many of them.

Anyway, it is an interesting area.

Slide 14 of the presentation ("exchange with Comcast") says that LMCA repurchased 6.3 million shares for $132 per share. How did they determine the repurchase price per share, given that assets other than cash were involved in the exchange?

ReplyDeleteSlide 19 ("investment milestones since last meeting") says that 8.1 million shares were repurchased for $1 billion. That would imply an average price of $123.46, but LMCA says the average price was $127.02. The share repurchases began before the Starz spinoff and include the Comcast exchange. Not sure how those things would affect the calculation. Any idea how they arrived at that figure?

In any case, isn’t the management implying that LMCA is undervalued at $132?

Thanks for your thoughts.

Hi,

DeleteThe LCMA price per share was the market price (10K); I think the amount of cash and other assets were adjusted to make them of equal value. The $1 billion repurchase number is probably rounded so that wasn't the exact figure.

And yes, I think management thought they got a good deal on the exchange at $132/share. The value does change, though, according to the stock market price of SIRI, CHTR, LYV etc...

Interested to hear your thoughts on the Liberty Media Corp & Liberty Broadband tracking stocks. By the way, I've enjoyed nearly all the posts on the blog. By coincidence I read The Outsiders about the same time and have taken a very similar approach to investing. Just a note of encouragement.

ReplyDeleteThanks.

DeleteI think it's a good idea; Malone has been doing this sort of thing for a long time. Tracking stock is just a first step, but eventually, I think a split makes sense because each business sort of has different standards in terms of how much debt it can carry, for example. So if they want to lever up on the broadband business, maybe it's better on it's own.

Other businesses like BRK show how they can add value and may be worth more as a whole, but for someone like Malone, he has shown that he can create value by separating the entities and that seems to work too.

You mention you own LMCA - how about LINTA or LBTYA? They all seem attractive for various reasons. As you stated LMCA definitely seems like the flagship and the upcoming spins have piqued my interest. LINTA also has the QVC spinoff coming up. And LBTYA by Malone's own admission seems to have the most opportunity, in terms of acquisitions. In any case, curious to hear your thoughts on how you rank or prioritize amongst the Liberty family.

ReplyDeleteHi, it's just a personal preference. I like how LMCA seems like the flagship vehicle etc. And I am one of those that have always been skeptical of QVC thinking that the internet will obliterate that business, but that obviously hasn't happened. As for LBTYA, yes, Malone seems to see more potential in Europe so it is very interesting but I just tended to be more comfortable with things in the U.S.

DeleteSo those are my reasons, but LINTA and LBTYA are both very interesting, no doubt.

LMCA is at $125/share now..How do you like the valuation and growth prospects with the spinoffs coming?

DeleteHi, there are a lot of moving parts here, and it's a little busy, but I bet they create value over time. Creating separate vehicles will allow them to optimize their balance sheets for the respective businesses so should be good (even though it's just a tracking stock at first).

DeleteTodd or Tedd with the 365m move into Charter! You must love that news...guess its not too unexpected though lol. Thought Id post it here anyways.

ReplyDeleteYes, it's nice to have good company. What's really interesting here, though, and good for fans of the Malone Media Complex, is that BRK has a lot of capital sitting around and they obviously like what Malone/Maffei are doing. So if they need funding they can always go to BRK. BRK may not necessarily be first call, though, but if they needed help getting something done I'm sure the folks in Omaha would be all ears.

Deletehi kk wonder if u attend liberty media investor day this year? any comments?

ReplyDeleteNo, but I just listened to the replay on their website. Things sound good, but nothing new. There were worries about HBO OTT and Obama's comments about title II, but they didn't sound overly worried about it. Malone has been saying that the bundled package is unsustainable for a while so is not surprised that unbundling is starting to occur. As for net neutrality, he didn't sound overly concerned. He doesn't think things have been completely thought through, and when it does, they will find some kind of agreement that will work for everyone.

DeleteAnyway, it's worth listening to the replay. It's a good presentation.

any views on SIRI's valuation? i'm actually more worried about SIRI at LMCA rather than LBRDA side. LBRDA has more support from BRK, the chopra fund and i believe some other solid value type investors. SIRI, despite its strong improvement in adjusted cash flows.still appear to trade at at rich valuation. of course jim meyer could always describe it as a large potential market for SIRI to expand into, and the relatively slow down of capex required to capture these customers (and thus to monetise them).at least to me, the disruptive threat to siri from streaming/spotify in uber, seem much stronger than fibre challenging charter's position in providing quality internet at relatively lower cost. i'm kind of tempted to switch out of lmca into more lbrda but still on the fence about it. afterall lmca is malone's largest position.

ReplyDeleteHi,

DeleteIt looks expensive nominally, but they realize a lot of free cash, so it's not so out of line on that basis. Plus it is growing.

As for the competitive threat, they do keep pointing out that SIRI is about a lot more than music. They have Howard Stern, for example. So it's about content other than music too; sports etc... Obviously, someone like me would have CNBC on if I was on the road on a weekday.

As for having the car connected to the internet, Meyer feels that's further down the road and can be an opportunity for SIRI too.

There are a lot of changes going on so it's very interesting.

Frankly, as an LMCA owner, I am more interested in what Malone does with SIRI than what SIRI will do over the next ten years (although they may not be two separate things). Malone is always thinking about how to create value; seeing if LYV and SIRI can work together to create more value, for example... or do so some deal down the line whether it be some sort of asset swap... use of tax assets etc...

So as an owner of LMCA, there is a dimension that goes beyond the stric analysis of SIRI, although understanding that story is important too.

The bet is that whatever happens in the industry, that Malone will be on the right side of it in some way.

This comment has been removed by the author.

ReplyDeleteDo you have any views on Liberty Broadband and the ongoing landscape with Charter, TWC and Bright House?

ReplyDeleteNot any more than anyone else. But I think you can be sure that whatever happens, Malone is going to be there and he is going to make money!

Delete