It's been pretty quiet around here. This post has been sitting in the queue for a long time, so I figure I'll just get it out now.

Things seem to be pretty fully priced. When I first started this blog back in 2011, banks / financials were cheap, analysts were bearish, the public hated banks (well, they still do) and Occupy Wall Street was in full force. That was one of the reasons I started the blog in the first place, to say that not all banks are evil, and no, banks aren't dead etc.

Market

I still feel the same about the market as I've been saying for the last couple of years. I am not really bullish or bearish, but I have no problem with valuations and don't really see a bubble, except in certain areas.

Yeah, it was scary when the market was down more than 1,000 points earlier this year. But I was not really all that worried. If this is a bubble and a top, it's one of the most timid bubbles of all time. At least that's what I think. Most bears talk about how much the stock market has rallied since the low, and I think that is nonsense.

If a stock goes from $100 to $50, and then back up to $100, is it really overbought? It might be. But not necessarily. If you look at previous bubbles, markets appreciated a LOT from the previous high. In this case, we are not that far above the 2007 peak.

Anyway, that's my view. I know many don't agree, but who cares, really.

Also, people seem to be freaking out that interest rates are rising. But all my bubble posts used 4% as the 'normalized' long term interest rate, and the market is not expensive, in my mind, even with interest rates at 4%, let alone 3%. So that, to me, is not yet a big concern. Of course, interest rates can overshoot due to higher than expected cyclical inflation. But that doesn't really concern me all that much. Sure, the market will tank on each interest rate uptick, but since the rubber band is not that stretched (in terms of the relationship between P/E and interest rates), there is no need for the market to go down all that much.

Buffett also keeps saying that stock market valuations are driven by interest rates. Critics say comparing earnings yield to bond yields is wrong as it compares 'real' versus 'nominal'; bond yields don't adjust to inflation but earnings yields do (over time as earnings will increase with inflation).

This is true, but if you make that argument, then maybe earnings yields have to be compared to the TIPs bond yields, which is 'real'.

10-year TIPs yields around 0.9% these days, so to compare real-versus-real, the stock market should be trading at 111x earnings. But don't forget, company earnings grow with the economy over time and not just with inflation, so stocks still have a 2% or so advantage over TIPs even at 111x P/E.

But of course, this is all just theoretical mumbo-jumbo. I wouldn't tell anyone with a straight face that the market should be trading at 100x P/E. I wouldn't pay that either, and if the S&P 500 index was trading that high, even I (the avid non-market-timer) would be long a boatload of puts!

Moving on...

Buffett

I watched the annual meeting and his long interview on CNBC and it was great as usual. But honestly, I don't remember the last time a question was asked and the answer wasn't something I would have guessed. The letter to shareholders too was the usual, and like others, I was surprised at how short it was. He is getting old so regardless of what he says, he is probably slowing down a little.

What might happen, and might be really cool, is if others contributed to the letter. Maybe Todd/Ted/Ajit /Greg can contribute a section in some way. That would be interesting, and would be a nice transitional thing to do.

Privacy/Facebook:Things seem to be pretty fully priced. When I first started this blog back in 2011, banks / financials were cheap, analysts were bearish, the public hated banks (well, they still do) and Occupy Wall Street was in full force. That was one of the reasons I started the blog in the first place, to say that not all banks are evil, and no, banks aren't dead etc.

Market

I still feel the same about the market as I've been saying for the last couple of years. I am not really bullish or bearish, but I have no problem with valuations and don't really see a bubble, except in certain areas.

Yeah, it was scary when the market was down more than 1,000 points earlier this year. But I was not really all that worried. If this is a bubble and a top, it's one of the most timid bubbles of all time. At least that's what I think. Most bears talk about how much the stock market has rallied since the low, and I think that is nonsense.

If a stock goes from $100 to $50, and then back up to $100, is it really overbought? It might be. But not necessarily. If you look at previous bubbles, markets appreciated a LOT from the previous high. In this case, we are not that far above the 2007 peak.

Anyway, that's my view. I know many don't agree, but who cares, really.

Also, people seem to be freaking out that interest rates are rising. But all my bubble posts used 4% as the 'normalized' long term interest rate, and the market is not expensive, in my mind, even with interest rates at 4%, let alone 3%. So that, to me, is not yet a big concern. Of course, interest rates can overshoot due to higher than expected cyclical inflation. But that doesn't really concern me all that much. Sure, the market will tank on each interest rate uptick, but since the rubber band is not that stretched (in terms of the relationship between P/E and interest rates), there is no need for the market to go down all that much.

Buffett also keeps saying that stock market valuations are driven by interest rates. Critics say comparing earnings yield to bond yields is wrong as it compares 'real' versus 'nominal'; bond yields don't adjust to inflation but earnings yields do (over time as earnings will increase with inflation).

This is true, but if you make that argument, then maybe earnings yields have to be compared to the TIPs bond yields, which is 'real'.

10-year TIPs yields around 0.9% these days, so to compare real-versus-real, the stock market should be trading at 111x earnings. But don't forget, company earnings grow with the economy over time and not just with inflation, so stocks still have a 2% or so advantage over TIPs even at 111x P/E.

But of course, this is all just theoretical mumbo-jumbo. I wouldn't tell anyone with a straight face that the market should be trading at 100x P/E. I wouldn't pay that either, and if the S&P 500 index was trading that high, even I (the avid non-market-timer) would be long a boatload of puts!

Moving on...

Buffett

I watched the annual meeting and his long interview on CNBC and it was great as usual. But honestly, I don't remember the last time a question was asked and the answer wasn't something I would have guessed. The letter to shareholders too was the usual, and like others, I was surprised at how short it was. He is getting old so regardless of what he says, he is probably slowing down a little.

What might happen, and might be really cool, is if others contributed to the letter. Maybe Todd/Ted/Ajit /Greg can contribute a section in some way. That would be interesting, and would be a nice transitional thing to do.

The latest thing in the press is about Facebook and privacy. One thing I don't understand is that when we joined Facebook, we sort of all assumed we will have no privacy there. That's why I don't have my real birthday there, no credit card information nor my social security number. I remember upsetting some people when I didn't put my real photo on the profile page. Well, my fear was that not too far in the future, people would be walking around with something like Google Glass, and they will know immediately who I am because of the facial recognition app that will no doubt be installed on it. The glasses will automatically see my face and do a search, find my image and profile (either from Facebook, Google+, LinkedIn or wherever.

If you are tagged even once on a public photo, the engine will be able to identify you anyway, even if your profile photos show a picture of Dexter Morgan. Once they know your name, the app will search through Linkedin, find out what you do and then maybe scan Glassdoor to estimate what you make etc... All of this will show up on the glasses, and will do so for anyone that is looked at. Creepy stuff. But that day is inevitable, I think. One day the IRS will get hacked; you will be sitting in the subway with your hi-tech glasses and look around and you will see the tax returns of every face you focus on. This is certain to happen, eventually. I have no doubt about that. This is the sort of thing that scares me. (but then again, I have nothing to hide, so I don't really care. It's just creepy)

But anyway, I was kind of surprised at all this outrage about FB; what did people expect? You fill out a questionnaire or do those silly trivia games and are shocked that someone is using that data?!

Actually, it seems like it is not affecting too many people, so maybe it's just the press going crazy over it and making more of a big deal out of it than your average FB user.

I still think mobile phone companies and credit card companies know far more about you than FB; those guys know where you are, what you spend money on going back decades etc. Creepy. But that's been true for a long time.

JPM

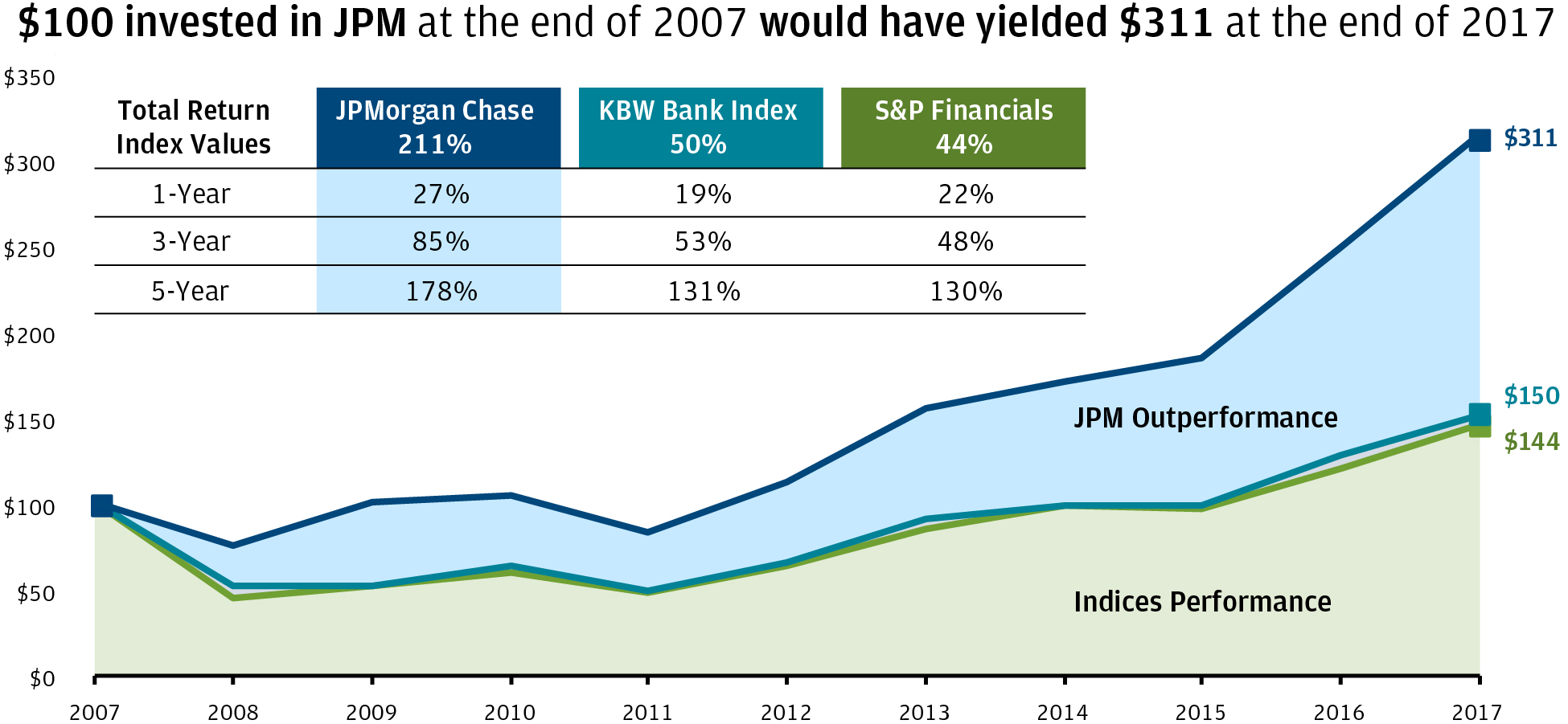

Anyway, as usual, the JP Morgan annual letter is a great read. No need to elaborate much on it, but as usual I love the charts they put in it and in the proxy. These are charts I've been following for years, even before they started to put them regularly in the reports.

Conference call

By the way, I usually listen to the JPM conference calls every quarter. There is a lot to learn from them, and when Dimon is on, he is usually pretty blunt, so fun (and educational) to listen to.

But one thing that I wonder about is the format. When you listen to some of the high-tech conference calls, what's cool is that some of them totally drop the summary and go right to Q&A. Do we really need someone to read off the highlights from each slide? I would rather that be cut and have a longer Q&A session, or have topics not covered in the slides. It seems kind of silly that someone just reads off something we all have already.

Amazon's meeting protocol is interesting. I think they spend 20 or 30 minutes reading the material (at the meeting) before they start discussing stuff. Obviously, there would be no need to have a conference call and be silent for the first 30 minutes... Maybe just release the documents 30 minutes sooner or whatever (I know they release it before the call, but just increase the time in between, maybe). Give people time to go over it so on the conference call, they can just focus on the Q&A, and maybe a short comment just highlighting important things.

But I don't know. Maybe the analyst community likes it that way as they have to sit through a bunch of these during earnings season and they like that slow time in the beginning so they can flip through the slides etc. But for others, it's a tedious section to sit through...

Bitcoin

I haven't changed my mind about bitcoin at all, and no, I haven't gone out and secretly bought some "just in case". Nope. Didn't do that and don't plan to. I continue to side with Buffett on this. And he had a good point in the interview/annual meeting: these things with no intrinsic value and where people can only make money if more people come into; people get angry when you speak out against it as they need people to come in for the price to go up.

I remember the anger and emotion when people spoke against gold too. But you never really see value investors get upset when bears talk down value stocks.

Hedge Funds

What's up with these big hedge funds? I don't know. I am a fan of the big hedge funds, generally, but many have been doing horribly in recent years. I am especially shocked how bad Einhorn is doing, as he seems to be making the same mistake that the big funds made back in the 1997-2000 rally. If you remember, guys like Julian Robertson and Stanley Druckenmiller had trouble back then, as shorting expensive stocks and buying value didn't work for a few years back then. One would think people wouldn't repeat that mistake, and yet, Einhorn is short a bubble basket.

Anyway, his analysis is probably right, and those stocks will probably go down or be valued more realistically at some point. But the problem is you could have argued that with Amazon and Netflix for years. Who is to say it has to 'normalize' within the next twelve months? And if it doesn't, the stocks can be up another 30%, 50%, or 100%. If the market is ignoring fundamental valuation, that just means something trading at 100x P/E can just as easily go to 200x P/E. Why would you want to get in front of that!? I don't know. But these guys are way smarter and richer than me, so who am I to say.

Average Holding Period of Stocks

People often talk about the average holding period of stocks, and how that has been shortened dramatically. I tend to think that analysis is flawed, as many of those figures use trading volume as one of the factors. Well, with all that HFT trading going on where portfolios can turn over 100% in minutes, that sort of skews the data. Just because a bunch of quants start trading with average holding periods in micro-seconds, that doesn't really affect the rest of us who still like to own stocks for 5, 10 or 20 years.

But anyway, not a big deal.

Ian Cumming/Leucadia

I realized way after the fact that Ian Cumming passed away earlier this year. I don't go to many annual meetings, but I will never forget the last LUK annual meeting with Cumming/Steinberg. I wrote about it here.

Not long after that, Leucadia changed it's name to Jefferies Financial Group and ticker symbol back to JEF. Oh well. I guess that reflects the reality that LUK is not really LUK anymore (and wasn't after the merger).

JPM

OK, so most of these are self-explanatory but let's look at some of the charts from the JPM 2017 annual report.

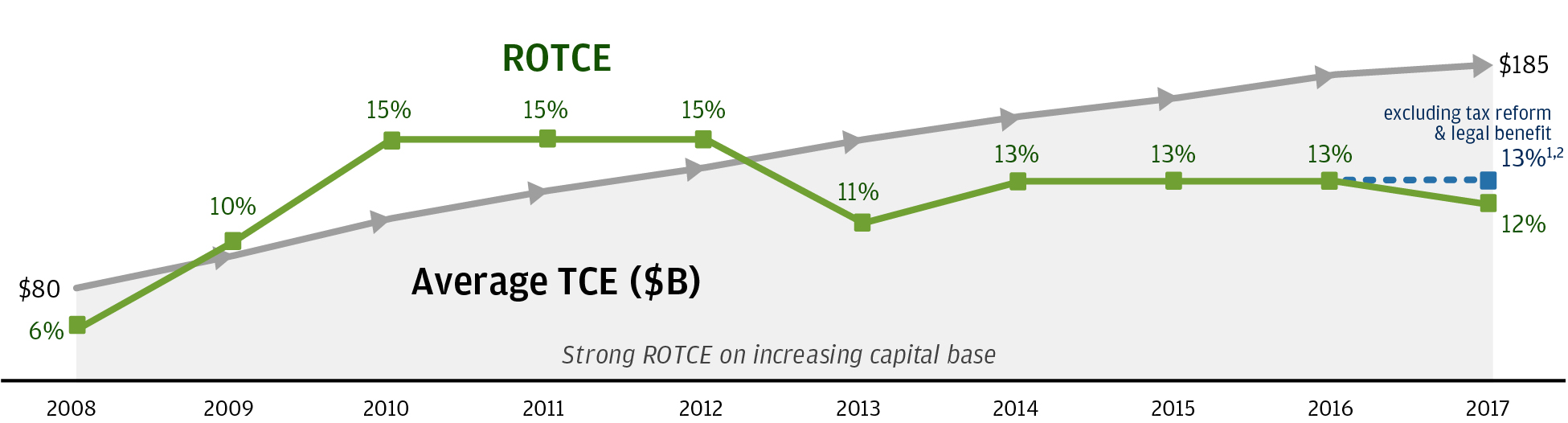

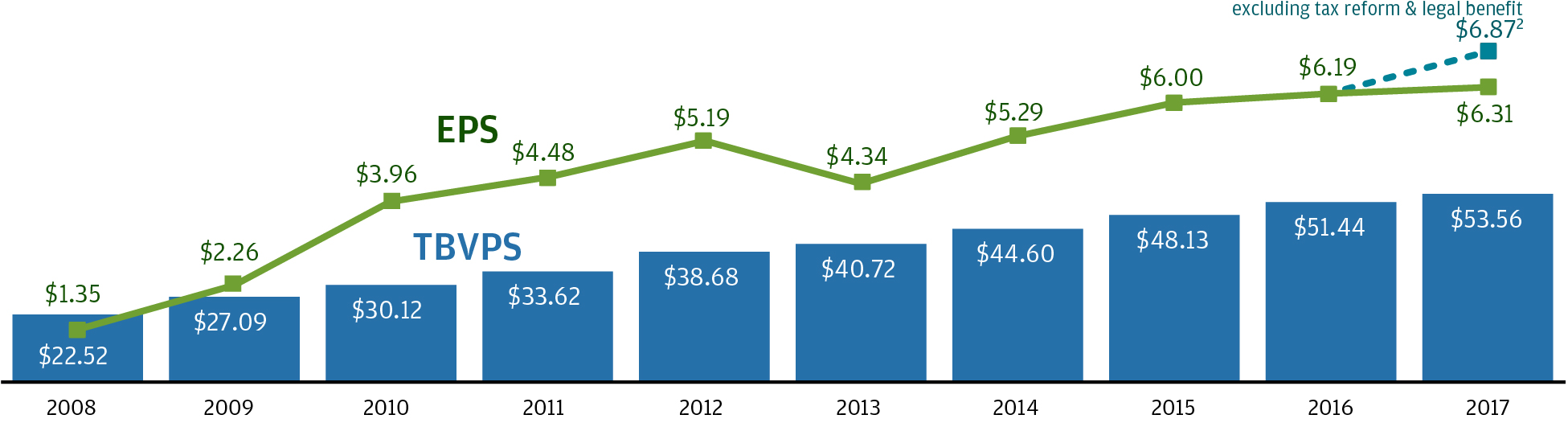

JPM is doing well against comps in terms of cost and return on tangible book.

Classic Dimon; snip from annual report:

I was recently at a senior leadership offsite meeting talking about bureaucracy. We heard bureaucracy described as “a necessary outcome of complex businesses operating in complex international and regulatory environments.” This is hogwash. Bureaucracy is a disease. Bureaucracy drives out good people, slows down decision making, kills innovation and is often the petri dish of bad politics. Large organizations, in fact all organizations, should be thought of as always slowing down and getting more bureaucratic. Therefore, leaders must continually drive for speed and accuracy to eliminate waste and kill bureaucracy. When you get in great shape, you don’t stop exercising.

Meetings. Internal meetings can be a giant waste of time and money. I am a vocal proponent of having fewer of them. If a meeting is absolutely necessary, the organizer needs to have a well-planned, focused agenda with pre-read materials sent in advance. The right people have to be in the room, and follow-up actions must be well-documented. Just as important, each meeting should only run for as long as it needs to and lead

I love these two quotes. I worked at a large company and it's so true. People tend to spend more time building and defending bureaucracies than building businesses at big places. Dimon talks about having war rooms to tackle urgent issues. Part of why that's so great is because the teams are put together for specific projects, and are presumably disbanded after the task is done.

The problem with big companies, oftentimes, is that a section or group is set up to deal with certain issues, but when those 'issues' are resolved or are no longer issues, the group or department, have to invent other reasons to keep existing. Or sometimes they don't even have to do that; the department survives with underemployed people doing nothing all day long (I have seen this). They can't shut down these divisions because there is no place for the managers to go, and they can't be demoted. With ever expanding companies, this is an issue as you have to sort of create more and more of these divisions that worthy employees can be promoted into.

There probably shouldn't even be departments/divisions at all. Teams should just exist temporarily for specific tasks and that's it. Once you create a department, it just creates incentive for the head of that department to get bigger, and of course, they will resist change when the environment changes. So ban divisions!

But of course, that's easier said than done. I am not a manager, so it's easy for me to say!

Moving on...

From Proxy:

1 TSR assumes reinvestment of dividends

The Firm has demonstrated sustained, strong financial performance

|

We have delivered sustained growth in both TBVPS and EPS over the past 10 years, reflecting compound annual growth rates of 10% and 19%, respectively, over the period.

1

|

ROTCE and TBVPS are each non-GAAP financial measures; for a reconciliation and further explanation, see page 115. On a comparable U.S. GAAP basis, for 2008 through 2017 respectively, return on equity (“ROE”) was 4%, 6%, 10%, 11%, 11%, 9%, 10%, 11%, 10% and 10%, and book value per share (“BVPS”) was $36.15, $39.88, $42.98, $46.52, $51.19, $53.17, $56.98, $60.46, $64.06 and $67.04.

|

2

|

Excludes the impact of the enactment of the Tax Cuts and Jobs Act of $2.4 billion (after-tax) and of a legal benefit of $406 million (after-tax). Adjusted net income and adjusted EPS are each non-GAAP financial measures; for further explanation, see page 115.

|

Anyway, there is not much more to say about JPM than to say that they continue to be doing really well. Their performance since 2008 is amazing no matter how you slice it; who would have guessed this performance back in 2008 as the financial market started to melt down?

I know I spent more time talking about random stuff than JPM, but whatever... I just want to get this out now so...